Neurochain: a treacability project

Project description

All good projects start with a vision. But not all good projects lead to good investment. Timing is key. Could this be the case with Neurochain, a breakthrough vision whose industrial application took more time than expected ? Let's dig in.

Disclaimer: I am an investor in Neurochain since June 2021 and plan to use $NCC token to run a bot. Current price reflects a distressed valuation.

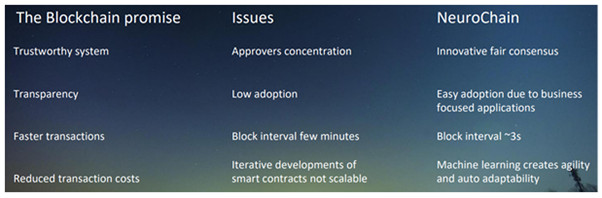

Back to 2018 and the issue of Neurochain White Paper : The usual way to boost productivity is by leveraging through People, Process and Technology. Blockchain according to the founders F. Goujon and B. Chouli is a new technology revolution, of the kind that are truly disruptive. The 2 founders can be considered as early adopters, since they co-wrote a book about chain of blocks in 2015 and have an impressive curriculum in Nuclear physics, mathematics, blockchain and AI. So, this time they identify a massive way to boost productivity and efficiency (blockchain) but Neurochain consider (with their vision from 2018) that existing blockchain tech does not deliver all its promises due to poor implementation (low TPS, suboptimal consensus).

Which is why they propose a Proof of Involvement and Integrity (PII) consensus (more on that later) for the new blockchain they want to construct.

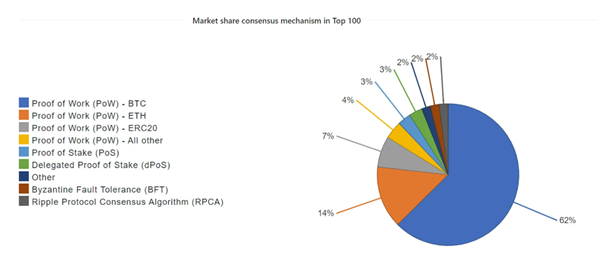

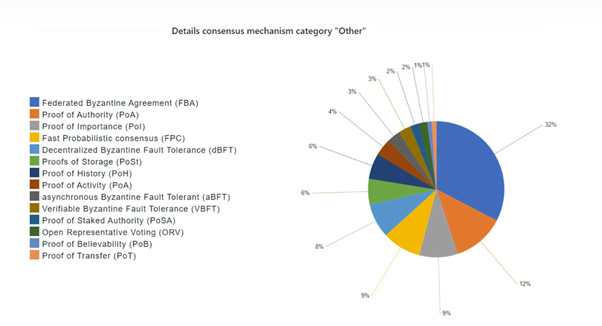

A disclaimer here: Since 2018 several types of consensus have since emerged (Proof of Authority by Vechain, Proof of History by Solana, …) In the analysis, they focus on the weaknesses of 2 consensus: Proof of Work (PoW) is leading to a computer capacities race and driving too much energy consumption. Proof of stake (PoS) is more green friendly but instead of a race to hardware, it leads to a race for higher stakes. In both cases somehow, the richer have an advantage. Since then, alternative consensus have emerged as shown in this examples taken from 2 years ago. The dominance of PoW has diminished a lot after ETH Merge, but PoW and PoS combined still represent the biggest chunk of market cap.

Q1: Have you continued monitoring the various types of consensus existing ? Do you think other consensus that now exist could have been used by Neurochain to achieve its goal, Or you think PII is still unparalleled ?

The breakthrough vision: Neurochain wants to embed machine learning and artificial intelligence within the blockchain itself, as a core design of the chain DNA, and not only as a function. This came 5 years before the Chat GPT induced hype so we can acknowledge that they had some interesting intuition.

They consider the smart contract as inefficient, in that all the outcomes of a scenario have to be identified and programmed. The smart contract is not so smart because it lacks autonomy. Neurochain want the bots to thrive in a stochastic world where adaptation to an ever changing environment is needed.

Q2: Do you consider that intelligence of the bots could benefit from existing market AI solutions ?

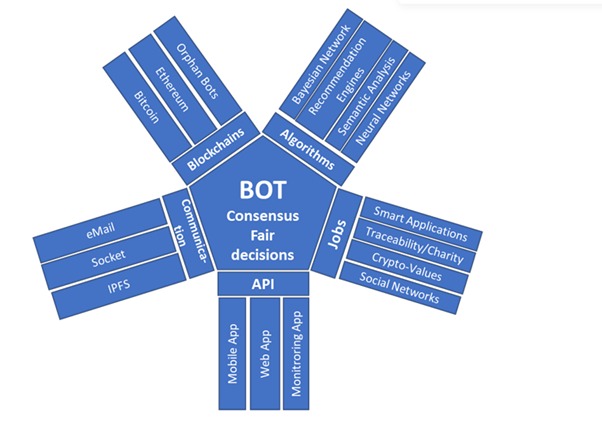

The scope targeted with the project was (is ?) quite large:

- Transfer of values

- Traceability (more on that later)

- Intelligent applications that are more evolved than smart contracts simply using rules, here it uses algorithms

- Social bots: be able to understand through semantic analysis exchanges between people and issue recommendations based on conversations

- Certified data repository

- IoT

Q3: Where do you stand on other applications such as IoT : is it realistic to expect future deliveries ?

4 key concepts for the chain to serve this purpose:

- Based on bots

- Bots bring together an evolving, ever-smarter ecosystem

- A new consensus: Proof of Involvement and Integrity

- Open source

Proof of involvement and integrity is based on 2 principles of thermodynamics: entropy and enthalpy.

1- Entropy is the ability of a Bot to interact with other Bots: effectively sharing information means good entropy.

2- Enthalpy relates to the quality of the interaction with other Bots: sharing critical information means good enthalpy.

Based on those 2 principles a scoring will be made and attributed to each bot. Then the bots with the higher score are considered as having the best behaviours and so will be more likely given validation tasks. This translates into this comparison:

Reading the white paper, you have the gut feeling that this could have been the Tesla of blockchain. Very solid tech, a super contender with a disruptive and forward looking vision that hardly existed at that time vision, with much ambition and conviction and skills. The first NeuroChain elements to be delivered were:

- The NeuroChain infrastructure (Blockchain Protocol)

- The Artificial Intelligence that will act as a part of the validation process

- The client software

- The Meta language based on C++ agent oriented (the Neuronal)

– The SDK (development kit for intelligent apps)

- The interface apps

- The tooling for web apps

- The fast deployment tools with automatic controls and online repositories

- The documentation to use it all.

The innovative consensus has been extensively detailed in a paper co-authored by F. Goujon and B. Chouli in the following Technical Whitepaper. They are definitely very skilled (just look at their bios). Reading this white paper triggers a lot of excitement as it opens infinite possibilities and there is no coincidence that the project was so successful in 2018. It also reminds in general that, however promising a use case and a technology, many things can happen that can impact future promises made to investors (tokenomics, management of the funds received, market exposure, lengthy development, absence of a real market fit, project too early).

Additional question: What do you think dragged the most on project development compared to initial plans ?

The paper mentionned above explains the Proof of Involvement and Integrity

Proof of Involvement

Defined by entropy and enthalpy as I briefly introduced above

1- The analogy between entropy and bot activity vaguely reminded me of the analogy between dust particles and stock prices random walk. In their foundational paper, the team asks readers to “imagine that each particle represents a Bot and the different states of the particle represent the transactional states of the Bot.” The entropy measures the level of interaction and involvement of the Bot.

2- The anthalpy now: The calculated entropy is also normalised by the strength or the Value of the transactions, which is called enthalpy. Entalpy will be a state function of the bot energy / intensity. Intensity can be for example the value of a transaction in USD. But if there is a convention implemented to measure other data, other measures could be used.

Proof of integrity

Defined through an integrity score that is based on

1- the bot reputation (Bayesian network with dynamic threshold.),

2- real value creation (based on new information injected in the network),

3- transparency represented by validated transactions and shared certified info / doc)

The proof of involvement and integrity is a linear combination of the involvement (entropy and enthalpy) and the integrity.

Once each bot has its score, an assembly of elected blocks is constituted, each block bringing a set of heterogeneous transactions from a pool of transactions. Election process is again mathematical inspired from nuclear physics, and eventually the validating bot will be drawn among those happy few selected.

The Proof of Involvement and Integrity consensus is based on the intrinsic value of information, methodologies, transparency and integrity created in the Blockchain.

Bots have 5 core pillars that define their role that make them intelligent and interconnected. Bots are envisioned in an elaborate way that they can choose which information protocol transfer they will use based on their needs (Single Mail Transfer Protocol, HTTPS, IPFS). The three communication channels presented here represent only one example of complementarity to achieve three main characteristics of the NeuroChain network: security, flexibility/scalability and traceability.

Q4: Do you still plan to use LiFI for better security of information transportation ?

Q5: In the white paper you mentioned there is one bot per participant (supplier, shipper, …). In this context, what is the rationale to have independent bots run by anonymous validators and how many ? Is it to avoid collusion of closed ecosystems ? Do all both have the same rights?

Let’s come back to application and focus on one particular type:

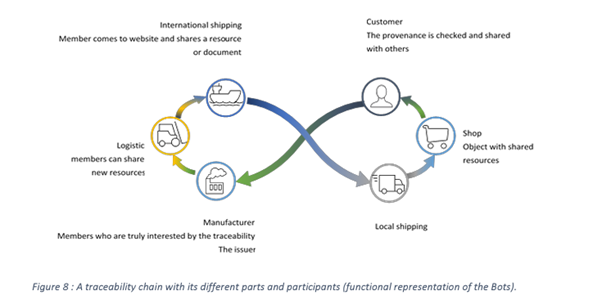

- Traceability. Traceability is the scope of the POC and I will quote the paper directly to explain how the protocol is intended to work:

All the Bots check if the transactions are valid, coherent and consistent with the certified documents (file storage is insured by the distributed IPFS protocol). The methodology and the algorithms of coherence and tracking are issued from the leader. All the Bots in the chain give allegiance to the leader and are motivated natively to spread the transactions in the network

Figure 8 shows the kinematics of the traceability chain where a single chain is assumed and consists of six Bots. Each Bot has its own role in the chain (producer, transporter, wholesaler, distributor and end customer). To ensure the link and transparency between the Bots, an autonomous communication is established in order to exchange on the objects, the concepts and the concerns of the chain. When an object or concept "A" is produced and validated by the producer, a message, like a transaction is sent to all the Bots of the Blockchain. All the Bots therefore trigger a validation process in order to check the coherence and validity of the transaction (according to the methodology initiated by the leader). As the transactions arrive on the Bots, an anomaly detection algorithm will also be implemented to validate transactions and detect malicious objects or inconsistent flows. In addition, an algorithm certification document based on the "IPFS" protocol is available when the Bots provide the documents (certifications or supporting documents). When a consensus on this transaction is reached, it will be incorporated into the Blockchain. After that, when the object is supported by the carrier, a new transaction is issued and the same validation process is reactivated. This will be repeated up to the end customer.

Link between the project and the token:

The NeuroChain’s crypto-currency is called CLAUSIUS, or “NCC” (for NeuroChain Clausius). The total supply ever will be NNC 4,374,000,000. Why Clausius? Because Rudolf Julius Emanuel Clausius (2 January 1822 – 24 August 1888) was a German physicist and mathematician and is considered one of the central founding fathers of the science of thermodynamics, whose principles Neurochain utilises.

The Tokens are utility tokens that will, once the Platform is developed, be used exclusively on the Platform. In particular, purchaser of NCC will have the right to:

- use the artificial intelligence paying fees and machine learning capabilities of the created blockchain platform. The main goal of NeuroChain's block size and fees is to prevent direct attacks in the network, such as denial of service attacks.

- create intelligent applications

- become Bots providing artificial intelligent and machine learning services in the NeuroChain network and therefore elected Bots during the election process, hence potentially earning Clausius (“NCC”) as a contribution for their election.

There is a strong bunch of disclaimers on what the NCC token does not.

“do not represent or confer any financial right on the economic results of the Company ; b) do not represent or confer any ownership right or stake, share or security or equivalent rights, intellectual property rights or any other form of participation in or relating to the Platform and/or Company and its corporate affiliates ; and is not intended to be a digital currency, security, commodity or any other kind of financial instrument. “

Relevant to escape requalification as a security: no revenue accruing to the token. The financial success of Neurochain does not mean success for the token.

Decryption: The token has been a way to raise money (100%) and is a utility token for the use of the service (x% probability – you can expect x to be zero and the token to loose total value)

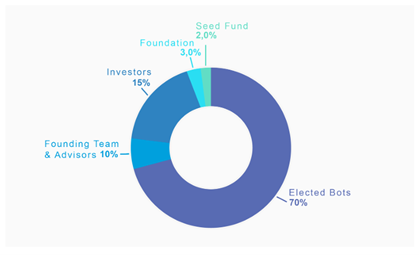

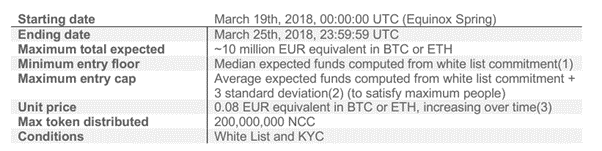

The total forged NCCs is distributed as follows:

The FDV currently stands at 4,155 million USD at a price of 0.00095

Circulating is then 30% of this, close to 1.3 million USD.

ICO price was based on 349 millions USD and at that time project was kind of starrish and shilled by the likes of Suppoman. A brief word on influencers and in general on other economic agents. As good as it may sound, everyone have a different agenda. When you see someone get short and copy trade them, do you know if they are naked selling or hedging ? Influencers make money by influencing. They do not really care if a project will succeed or not, whether industrially or financially. Someone you follow on Twitter invests 10k on a project. You trust the track record and invest 10k. But, 10k represent only 1% of his assets while your 10k are 1 year of savings. So yes, everyone have a different agenda, never lose sight of that.

So basically, this is a -99% performing coin. Bad omen for a coin, it got delisted from Huobi, and is untracked in Coinmarket cap and Coingecko. You need to go on the underground Dextool to find some elements on price.

Recently it got listed on a minor exchange I had never heard of before called Coinstore. Liquidity is awfully narrow and looks like wash trading. Cannot buy and cannot sell basically. Coin does alternatively -90% and then gets multiplied by 10 on thiny orders.

So the price is nastily down but contrary to many projects in such bad price shape it has a working product and there is still in theory a use case for the token. Which as I stated before does not have a bijective consequence on token performance.

Project progress

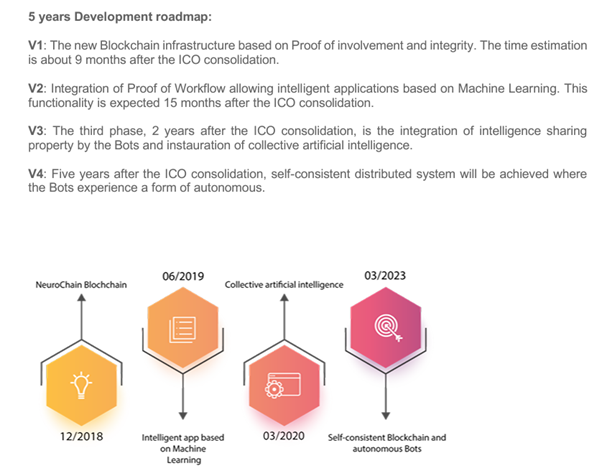

The roadmap was based on 5 years and we have no explicit vision apart from a POC that just got delivered.

Interestingly there was a 3 year void in the roadmap that had no update since.

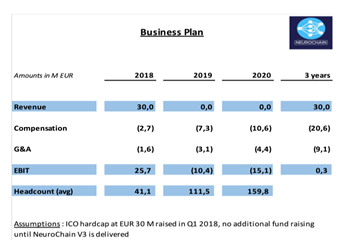

Business plan has been very deviating from what happened. From what we know the team size must be much smaller.

Funds were expected to be used in RnD mainly

- Consensus and blockchain performances

- Security, cryptography and anomaly detection

- Communication and technology

- Architecture

NCC Token balances can be found here:

https://etherscan.io/token/0x5d48f293baed247a2d0189058ba37aa238bd4725#balances

I have no view on ETH treasury status as of now nor how it was used.

Q6: What is the capitalistic structure of Neurochain ? It could be still a solution to issue capital to get funding enabling to then launch activity and accrue utility for the token by financing new use cases.

Team update

- Frederic Goujon and Billal Chouli are the main contributors, still active

- Bruno Delahaye, CMO: left after a few months

- Rogier van der Wal: shot a video 4 years ago and no mention of Neurochain in his bio

- Patrice Guichard: no sign still working on it

- Maxim Irishkin, scientific adviser: no sign still active

I will stop there as even in 2018 many of the contributors did not mention Neurochain as you can see in this background checking.

You can find in the general disclaimer of the business oriented paper a very cautious approach that is a reminder that you and only yourself is the sole responsible of your investment

“None of the information or analyses in this White Paper is intended to provide a basis for an investment decision.”

Project update:

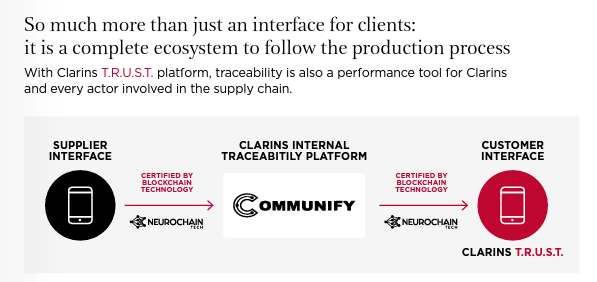

Now, Neurochain has delivered a POC (Proof of Concept) with Clarins. In itself this is a major news that got totally unnoticed.

Clarins is a cosmetics company that tends to be more and more high end whose turnover and growth are dramatic and remind the likes of L’Oreal or Hermes at their times.

Clarins experienced growth of +15% in its turnover in 2022, reaching 1.75 billion euros.

Some other elements:

- +20% compared to 2019 (before pandemic).

- Digital represents 20% of Clarins sales

- Objective of reaching 2 billion euros in turnover.

- Clarins is present in 140 countries, including France (6% of sales, +9% in 2022), Europe (38% of sales), China (leading market, +6% in 2022), the Asia- Pacific (41% of sales) and the United States (third market, 22% of sales, +11% in 2022).

- In 2022, the Spanish Clarins market grew by +23%.

- The company aims to reach 80% organic ingredients by 2025, compared to 60% currently.

- The Precious range has already accounted for 10% of sales in China since its launch in October.

It is about bringing to supply chain what blockchain is the best to deliver: traceability from the supplier until the client. With the rise of RSE and ESG and a general lower tolerance of the world with risks, traceability will progressively become a standard. 90% of some clients surveyed consider that a brand’s transparency plays an important role in the decision to purchase a product, or not.

30 products are now traceable and nearly 100 will be in 2023 is the objective.

So this is positive and shows the project is still active but that the technology gets a substantial validation. Neurochain is neither a scam nor a rug, let’s be clear.

However, the scale is very far from what was anticipated. Neurochain is still in a start-up mode 5 years later when the expectations were for mass adoption.

The other uncertainty is the use of the token. Is the NCC used for this private experiment ? There is nothing on chain that enables to say so. Raising money in 2018 was like receiving a blank check without any possibility of control. 2018 investors have a PTSD in that sense and this is why the current price reflects almost no hope. Is the market right ? Let’s ask

Q7: Is the token used in the case of private application i.e. is it tokenless as it is private ? More generally, can we expect a dual architecture for neurochain: private and tokenless, AND public with token

Questions recap:

- Have you continued monitoring the types of consensus ? Do you think other consensus that now exist could have been used by NCH to achieve its goal , Or you think PII is still unparalleled ?

- Do you consider that intelligence of the bots could benefit from existing market AI solutions ?

- Where do you stand on other applications ? IoT ?

- What do you think dragged the most on project development compared to initial plans ?

- Is the token used in the case of private application i.e. is it tokenless as it is private ? More generally, can we expect a dual architecture for neurochain: private and tokenless, AND public with token

- What is the capitalistic structure of Neurochain ? it could be still a solution to issue capital to get funding enabling to then launch activity and accru utility for the token

- Do you still plan to use LiFI ?

- In the white paper you mentioned there is one bot per participant (supplier, shipper, …). In this context, what is the legitimacy to have independent bots run by anonymous validators and how many ? Is it to avoid collusion of closed ecosystems ?

Where do we stand now on Neurochain as an investment ?

The valuation of a project is something that relates to some “not so secret” potion that still would need to be objectivised. In what drives the value of a token you have the following elements. Disclaimer: this is a tentative framework reflecting how I assess a project from a semi qualitative manner:

- Founders credibility and track record: 4/5

- Positioning (sustainable, green, …): 5/5

- Project Transparency: 1/5

- Number of commits / number of devs: 0/5

- Real deliveries: 3/5

- Partnerships: 2/5

- Hype / narrative: 3/5

- Tokenomics: 3/5

- Newsflow: 2/5

- Community support: -1/5

- Marketing power: 0/5

- Price history: 0/5

- Liquidity: 0/5

- Direct utility: 0/5

- Indirect utility (ex: in defi, as collateral): 0/5

- Relative valuation: 3/5

This will derive a global appreciation score to be weighed by a redflag multiplier

- Red flags multiplier: a multiplier applied to the global score. Red flag score is between 5 (huge red flag and nothing is priced) and 0 (the worse has happened and is already priced). Then we create the Red flag multiplier = (5-red flag score) /5

Note that some of the variables are clearly interconnected and a proper model would need to objectivise also these dependencies.

Luna would have a 5/5 global score but with a red flag multiplier of 4, meaning it was not as good as it looked from a pure scoring perspective. In the case of Luna that I know well one red flag was: use of ponzinomics with the refill of Anchor by Luna tokens, and another the recursive scheme with Magic Internet Money. Existence of a red flag means be ready to sell when it does materialize, have a stop loss, lower exposure. Sleep light, a catastrophe could happen anytime and this should not come as a surprise.

For NCC the redflag score is close to maximum, which is positive. Worse is priced in. Red flag multiplier = 4/5.

1- Founders credibility and track record: 4/5.

a. Let’s be clear: B. Chouli and F. Goujon are gigabrains with unparalleled knowledge in crossing AI and blockchain and nuclear physics. Founders are credible but have been under the radar and not having the usual attitude expected from blockchain projets that raised funds publicly.

2- Project transparency: 1/5

a. There is close to no transparency, also for the reason that the POC was private / almost secret linked to protection of industrial competitiveness I think

3- Positioning (sustainable, green, …): 5/5

a. The positioning of the blockchain is as good as it can be: green, and using AI.

4- Number of commits / number of devs: 0/5

a. Nothing since 2018

5- Real deliveries: 3/5

a. Many projects will never achieve what neurochain has done.

6- Partnerships: 2/5

a. Special mention for Clarins which is a reputed name. But it pales in comparison to activism of Polygon which would be a definitive 5/5

7- Hype / narrative: 3/5

a. In theory this is a 5/5 but the hype is unnoticed due to the low profile of the company and absence from Twitter, Discord, etc

8- Tokenomics: 3/5

a. Fairly balanced but this is kind of old story

9- Newsflow: 2/5

a. Recent news is positive but at this stage it is difficult to grasp its importance as we have no view on the token usage. And, since the POC lasted for several years we have no view on the time to market.

10- Community support: -1/5

a. Negative. It is negative because community members are the ones that spit the most on the project, as the value of their investment has been severely affected. Community is extremely angry. ICO got extremely hyped, including by the infamous Suppomanthat you can identify easily: Any coin Suppoman shills, gets a prospective return of 50x to 100x, even if that would bring the total cap to the level of the world GDP.) So, between a dreadful selling pressure, a lack of communication by the team, and an absence of tangible results, early investors got washed out. Which let’s be clear is expected in crypto, however disappointing and damaging it may be. If I take my personal case, I got deceived several times (ORIGAMI project for decentralised market place >> they raised funds with ICO but never deployed any solution involving the token; Iungo, sort of Helium project in 2018, they raised tremendous amount of money, so much that the incentive to deliver was non existent: why bother doing a hard delivery when you are already extremely rich ? Not everyone can be relied on.

11- Marketing power: 0/5

a. There is no marketing apart from scarce communications.

12- Price history: 0/5

a. Abysmal performance of -99pct since ICO. Saying goes and tends to show that strong community are linked by the memory of past strong performance at least for some time. NCC has always been down apart from a pump and ump 2 years ago.

13- Liquidity: 0/5

a. Liquidity is Abysmal.

14- Direct utility: ?

a. Big question mark; Theoretical utility based on the white paper but no view in practice. I will then put 0 conservatively.

15- Indirect utility (ex: in defi, as collateral): 0/5

16- Relative valuation: 3/5

a. Valuation is low compared to other traceability projects, but a direct consequence of the above

17- Red flag multiplier: 4/5

Overall score: 1.36/5

Verdict: Neurochain is very risky and the fact that it did not react to the partnership announcement shows that the market does not believe in the value of the token. Its overall score shows that based on existing information it is still a very risky digital gamble. This is an off the money contingent call option. Answers by the team to the question could drastically change the perception of investability. There will be time to invest once and if there is a confirmation that the token has a utility, and once we have a view on the treasury and the funds runtime. In that case, I would consider it could be a nice recovery to play for a very minimum investment. NFA.

- 4 191 words